forex

:max_bytes(150000):strip_icc()/shutterstock_274220507-5bfc33a546e0fb00517d6e77.jpg)

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the global marketplace. It is the largest and most liquid market in the world, with trillions of dollars being traded daily.

What is Forex?

Forex refers to the decentralized global marketplace where currencies are traded. Unlike other financial markets, forex operates 24 hours a day, five days a week, allowing traders to participate at any time. The main goal of forex trading is to profit from the fluctuations in currency exchange rates.

How Does Forex Trading Work?

Forex trading involves buying one currency and simultaneously selling another. Currency pairs are traded, with the value of one currency relative to the other constantly changing. Traders speculate on whether a currency will appreciate or depreciate, and make trades based on their predictions.

Benefits of Trading Forex

Forex trading offers several advantages:

- Accessibility: The forex market is accessible to individual traders with a relatively small amount of capital, allowing for greater participation.

- Liquidity: Due to its size, the forex market offers high levels of liquidity, meaning traders can easily enter and exit positions at any time without significant price differences.

- Leverage: Forex trading allows traders to use leverage, which means they can control larger positions with a smaller amount of capital. This amplifies potential profits, but also increases the risk of losses.

- Global Market: Forex trading allows traders to participate in the global economy and take advantage of opportunities arising from international events and economic news.

In conclusion, forex trading is a dynamic and accessible market where traders can profit from currency fluctuations. However, it is important to understand the risks involved and develop a solid trading strategy.

Getting Started with Forex Trading

Choosing a Forex Broker

When beginning your journey into forex trading, it’s important to choose a reputable and reliable forex broker. Look for a broker that is regulated, has competitive trading fees, offers a user-friendly platform, and provides educational resources and customer support. Take the time to research different brokers and read reviews from other traders to ensure you make the right choice for your trading needs.

Setting Up a Trading Account

Once you have chosen a forex broker, the next step is to set up a trading account. This typically involves filling out an application, providing identification documents, and depositing funds into your account. Each broker will have its own requirements and processes, so be sure to follow their instructions carefully to get your account up and running smoothly.

Understanding Basic Forex Terminologies

Before diving into forex trading, it’s essential to familiarize yourself with basic forex terminologies. Some common terms you will encounter include currency pairs, pips, leverage, margin, and stop-loss orders. Understanding these terms will help you navigate through the forex market and make informed trading decisions. Take advantage of the educational resources provided by your broker or research online to learn more about these key terminologies.

Remember, forex trading involves risk, and it’s important to have a solid understanding of the market and trading strategies before you start investing real money. Start with a demo account to practice your trading skills and gain experience before transitioning to live trading.

Fundamental Analysis in Forex Trading

Economic Indicators and their Impact on Currency Values

Fundamental analysis plays a crucial role in determining the value of currencies in the forex market. Economic indicators, such as Gross Domestic Product (GDP), inflation rates, and employment data, can have a significant impact on currency values. Traders analyze these indicators to assess the health and stability of a country’s economy, which can influence the strength or weakness of its currency.

News Events and Market Sentiment

In addition to economic indicators, news events and market sentiment also affect currency values. News about geopolitical tensions, trade agreements, central bank policy decisions, and other significant events can create volatility in the forex market. Traders use fundamental analysis to gauge market sentiment and predict how these events will impact currency prices.

Using Fundamental Analysis to Make Trading Decisions

Traders who employ fundamental analysis use economic data, news events, and market sentiment to make informed trading decisions. By understanding the factors that drive currency values, they can identify trading opportunities and manage risks more effectively. Fundamental analysis provides a broader perspective on the forex market and helps traders navigate through volatile market conditions.

Overall, fundamental analysis is a critical tool in forex trading as it helps traders understand the underlying factors that influence currency values. By staying informed about economic indicators, news events, and market sentiment, traders can make more informed decisions and increase their chances of success in the forex market.

Technical Analysis in Forex Trading

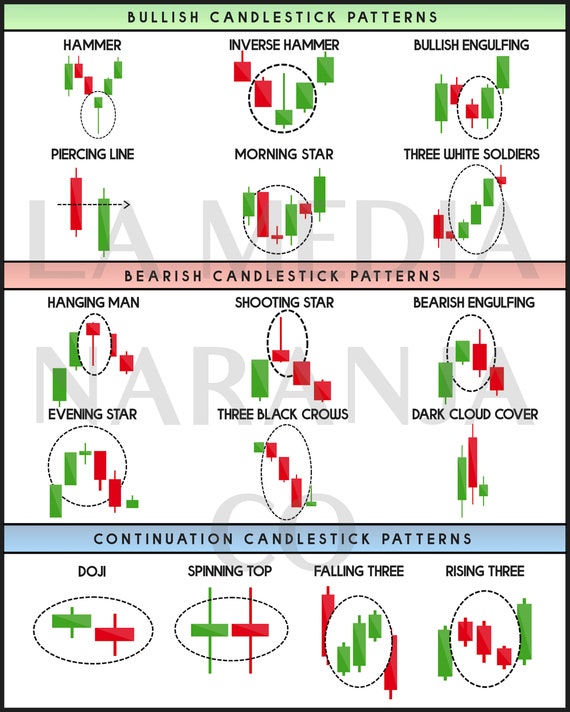

Candlestick Patterns and Chart Analysis

When it comes to technical analysis in forex trading, understanding candlestick patterns and chart analysis is crucial. These patterns provide valuable insights into market trends and potential reversals, helping traders make informed decisions. By studying price movements and recognizing patterns such as doji, hammer, and engulfing, traders can anticipate future price movements and identify entry and exit points.

Indicators and Oscillators

Indicators and oscillators are essential tools in technical analysis. They help traders analyze price data and identify market trends, overbought or oversold conditions, and potential trading opportunities. Commonly used indicators include moving averages, relative strength index (RSI), and stochastic oscillator. By combining multiple indicators, traders can gain a more comprehensive view of the market and refine their trading strategies.

Building a Trading Strategy with Technical Analysis

Technical analysis plays a vital role in building a successful forex trading strategy. Traders can use various technical analysis tools and techniques to identify trends, set entry and exit points, and manage risk. By using historical price data, chart patterns, and indicators, traders can develop a systematic approach to trading and improve their overall profitability.

In conclusion, technical analysis is an indispensable part of forex trading. Understanding candlestick patterns, utilizing indicators and oscillators, and building a solid trading strategy based on technical analysis can greatly enhance a trader’s chances of success in the forex market.

:max_bytes(150000):strip_icc()/risk_management-5bfc36abc9e77c005182400f.jpg)

Risk Management in Forex Trading

Importance of Risk Management

When it comes to forex trading, risk management is crucial. It involves taking steps to protect your capital from potential losses. By implementing effective risk management strategies, traders can minimize the impact of unpredictable market conditions and make more informed decisions.

Setting Stop Loss and Take Profit Levels

One of the key aspects of risk management in forex trading is setting stop loss and take profit levels. A stop loss order is placed to limit the amount of loss a trader can incur, while a take profit order helps protect profits by automatically closing a position when a predetermined level of profit is reached.

Managing Leverage and Position Sizing

Managing leverage and position sizing is another important element of risk management. Leverage amplifies both profits and losses, so it’s crucial to use it wisely. By properly managing leverage and carefully determining position sizes, traders can control their level of risk exposure and protect their accounts from significant losses.

In conclusion, risk management plays a vital role in forex trading. By understanding the importance of risk management, setting stop loss and take profit levels, and managing leverage and position sizing, traders can minimize losses and improve their overall trading success.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Ins_and_Outs_of_Forex_Scalping_Dec_2020-01-81923a49069940e09317c2eb3bb8b3cc.jpg)

Advanced Forex Trading Strategies

When it comes to the foreign exchange market, experienced traders know that having a repertoire of advanced strategies is essential for long-term success. Here are three powerful techniques that can take your forex trading to the next level:

Scalping Strategies

Scalping is a high-frequency trading technique that aims to profit from small price movements. Traders using this strategy typically hold positions for minutes or even seconds, making numerous trades throughout the day. To succeed in scalping, traders need to have a solid understanding of market dynamics and use advanced tools such as technical indicators.

Swing Trading Techniques

Swing trading involves capturing medium-term trends in the market. Unlike day trading, swing traders hold positions for several days to weeks. This strategy focuses on taking advantage of market fluctuations and patterns. Successful swing traders use technical analysis, chart patterns, and trend analysis to identify entry and exit points.

Carry Trading and Arbitrage Opportunities

Carry trading involves profiting from the interest rate differentials between two currencies. Traders borrow in a currency with a low-interest rate and invest in a currency with a higher interest rate, making money from the interest rate differential. Arbitrage, on the other hand, involves exploiting price inefficiencies across different markets to make risk-free profits.

By mastering these advanced forex trading strategies, traders can enhance their profitability and navigate the complexities of the foreign exchange market with confidence. Remember, practice and experience are key to successfully implementing these techniques, so start small and gradually expand your trading skills.

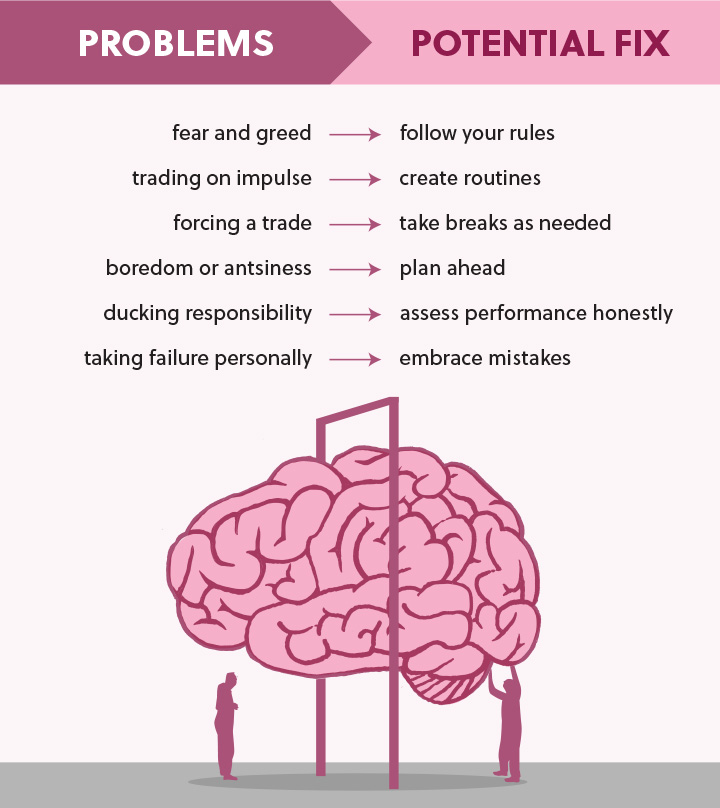

Trading Psychology and Emotions Management

When it comes to forex trading, managing your emotions is just as important as understanding the market trends. Emotions like fear and greed can cloud your judgment and lead to poor trading decisions. By keeping emotions in check, you can improve your chances of success in the forex market.

Keeping Emotions in Check while Trading

- Stay Calm: It’s crucial to stay calm and level-headed while trading. Take a deep breath and focus on the facts rather than getting overwhelmed by emotions.

- Stick to Your Strategy: Having a well-defined trading strategy will help you make consistent decisions even when emotions are running high. Stick to your plan and avoid impulsive actions.

- Manage Risk: Emotional trading often results in taking unnecessary risks. Set clear risk management strategies and adhere to them diligently.

- Practice Patience: Forex trading requires patience. Avoid getting caught up in short-term fluctuations and focus on long-term goals.

- Learn from Mistakes: Emotions can lead to mistakes, but it’s important to learn from them. Analyze your trading decisions, identify the emotional triggers, and make adjustments to improve your future trades.

By mastering your emotions and developing a disciplined approach, you can become a more successful forex trader. Remember, success in trading goes beyond technical analysis – it also includes managing your emotions effectively.

Forex, also known as foreign exchange, is the buying and selling of currencies. It is the largest financial market in the world, with a daily trading volume of over $5 trillion.

Forex trading is done by individuals, businesses, and central banks. Individuals trade forex for a variety of reasons, such as to make money, to speculate on currency movements, or to hedge against currency risk. Businesses trade forex to pay for goods and services from other countries or to invest in foreign markets. Central banks trade forex to manage their currencies and to influence the economy.

Forex trading is done on the over-the-counter (OTC) market, which means that there is no centralized exchange. Forex traders buy and sell currencies through a network of banks and currency dealers.

Forex trading can be a risky but potentially lucrative activity. Forex prices can move quickly and unpredictably, so traders need to be aware of the risks involved before trading.

Here are some of the factors that can affect forex prices:

- Economic growth: Economic growth in a country tends to lead to a stronger currency for that country.

- Interest rates: Higher interest rates tend to attract foreign investment, which can lead to a stronger currency.

- Inflation: Inflation can erode the value of a currency and lead to a weaker currency.

- Political stability: Political instability in a country can lead to a weaker currency.

- Market sentiment: Investor sentiment can also affect forex prices. If investors are bullish on a particular currency, its price will tend to rise.

Forex trading can be a complex and challenging activity, but it can also be a rewarding one. Traders who are able to understand the factors that affect forex prices and manage their risk can potentially make a lot of money.

Here are some tips for forex traders:

- Do your research: Before you start trading forex, it is important to do your research and understand the risks involved.

- Start small: It is always best to start small when you are first starting out. This will help you to learn the market and to minimize your losses.

- Use a stop-loss: A stop-loss is an order to sell a currency if its price falls below a certain level. This can help you to limit your losses.

- Manage your risk: It is important to manage your risk when trading forex. This means not putting all of your money into one trade.

- Be patient: It takes time and practice to become a successful forex trader. Don’t expect to get rich quick.

If you are interested in trading forex, there are a number of resources available to help you get started. There are books, websites, and even courses that can teach you the basics of forex trading.