forex eur usd

For those interested in the world of finance and international trade, the forex market offers a range of opportunities. One of the most widely traded currency pairs in this market is EUR/USD. Understanding the basics of forex and the significance of this particular currency pair is essential for any aspiring trader.

What is Forex?

Forex, short for foreign exchange, refers to the global market where currencies are bought and sold. It is the largest financial market in the world, with trillions of dollars worth of transactions taking place each day.

Understanding EUR/USD as a Currency Pair

EUR/USD represents the exchange rate between the euro (EUR) and the US dollar (USD). This currency pair indicates how many US dollars are needed to buy one euro. For example, if the current exchange rate is 1.20, it means that 1 euro is equivalent to 1.20 US dollars.

Importance of EUR/USD in the Forex Market

EUR/USD is considered one of the most significant currency pairs in the forex market. Both the euro and the US dollar are major global currencies, and their exchange rate influences various aspects of international trade, investment, and economic stability. Traders closely monitor EUR/USD as it provides insights into market sentiment, economic trends, and potential trading opportunities.

By keeping an eye on this currency pair, traders can make informed decisions, take advantage of market fluctuations, and potentially profit from trading EUR/USD. However, it is important to note that forex trading involves risks and requires careful analysis and understanding of market dynamics.

:max_bytes(150000):strip_icc()/dotdash_Final_Forex_Identifying_Trending_And_Range-Bound_Currencies_Jul_2020-01-97a8345d8fdb48819922e852ab9ad9f4.jpg)

Factors Affecting the EUR/USD Pair

Economic Indicators and their Impact

The exchange rate between the Euro (EUR) and the US Dollar (USD) is influenced by various economic indicators. These include GDP growth rates, inflation, interest rates, and employment figures. Positive economic data for the Eurozone can strengthen the Euro against the Dollar, while negative data can lead to a weaker Euro. Likewise, strong economic data from the United States can strengthen the Dollar against the Euro.

Government Policies and Central Bank Actions

Government policies and central bank actions also impact the EUR/USD pair. Fiscal policies, such as tax reforms and government spending, can affect the economies of both the Eurozone and the United States. Additionally, central bank decisions regarding monetary policy, including interest rate changes and quantitative easing measures, can have a significant impact on the exchange rate.

Geopolitical Factors and Market Sentiments

Geopolitical factors and market sentiments play a role in the EUR/USD pair. Political events, such as elections, trade negotiations, and conflicts, can create uncertainty and affect investor confidence. Furthermore, market sentiments, including risk aversion or risk appetite, can influence the demand for safe-haven currencies like the US Dollar or riskier currencies like the Euro.

Understanding these factors is crucial for traders and investors involved in the forex market. Monitoring economic indicators, government policies, central bank actions, geopolitical developments, and market sentiment can help form a better understanding of the EUR/USD pair and make informed trading decisions.

Analyzing EUR/USD Charts and Patterns

Technical Analysis Tools for EUR/USD Trading

When trading the EUR/USD currency pair, it’s important to use technical analysis tools to make informed decisions. Some commonly used tools include moving averages, trend lines, and oscillators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools help traders identify trends, entry and exit points, and potential reversals in the market.

Common Chart Patterns in EUR/USD

Chart patterns are visual representations of market behavior and can provide valuable insights for EUR/USD traders. Some common chart patterns include head and shoulders, double tops and bottoms, triangles, and flags. Recognizing these patterns can help traders anticipate potential price movements and make more accurate predictions.

Identifying Support and Resistance Levels in EUR/USD

Support and resistance levels are areas on the price chart where the buying and selling pressure is significant. Identifying these levels can help traders determine potential entry and exit points. Support levels act as a floor for prices, while resistance levels act as a ceiling. By analyzing historical price data and using indicators like pivot points, Fibonacci retracements, and horizontal lines, traders can identify key levels to watch for in the EUR/USD market.

Remember, trading the EUR/USD requires a combination of technical analysis, risk management, and market knowledge. It’s important to practice due diligence and continually educate yourself to improve your trading strategies and increase your chances of success.

Strategies for Trading EUR/USD

Long-Term Trend Following Strategy

When trading EUR/USD, a long-term trend following strategy involves identifying the overall trend of the currency pair and trading in line with it. Traders look for sustained upward or downward movements and aim to ride the trend for longer periods.

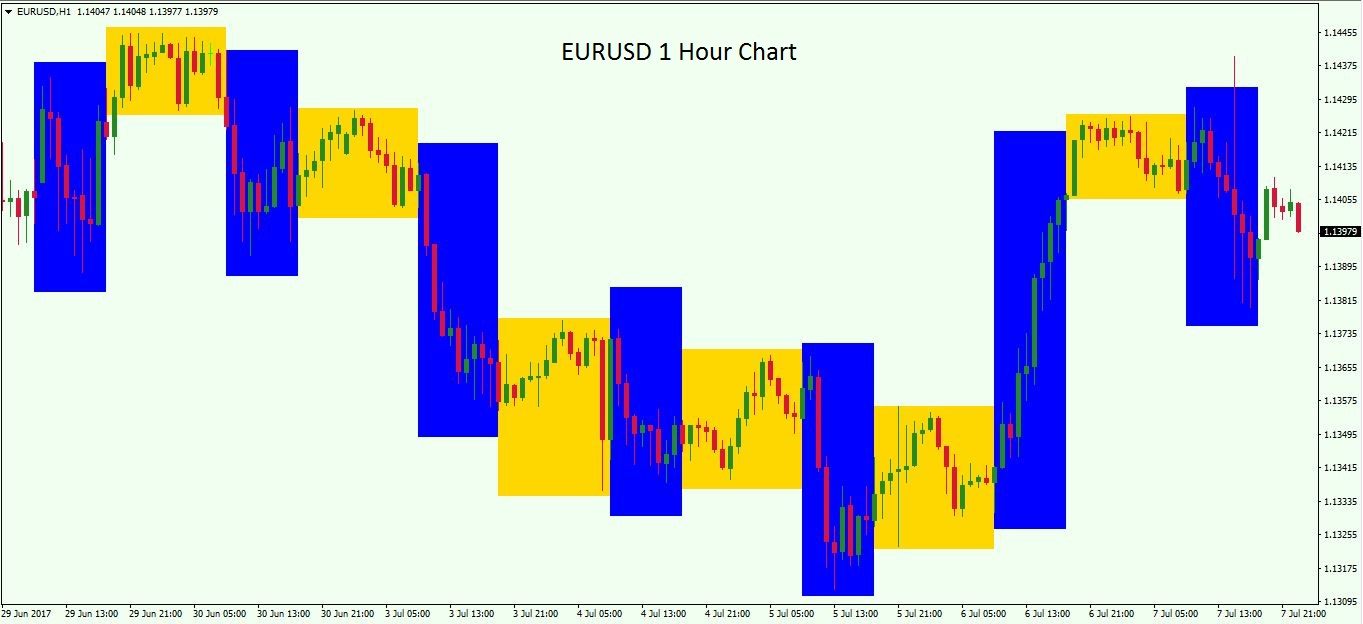

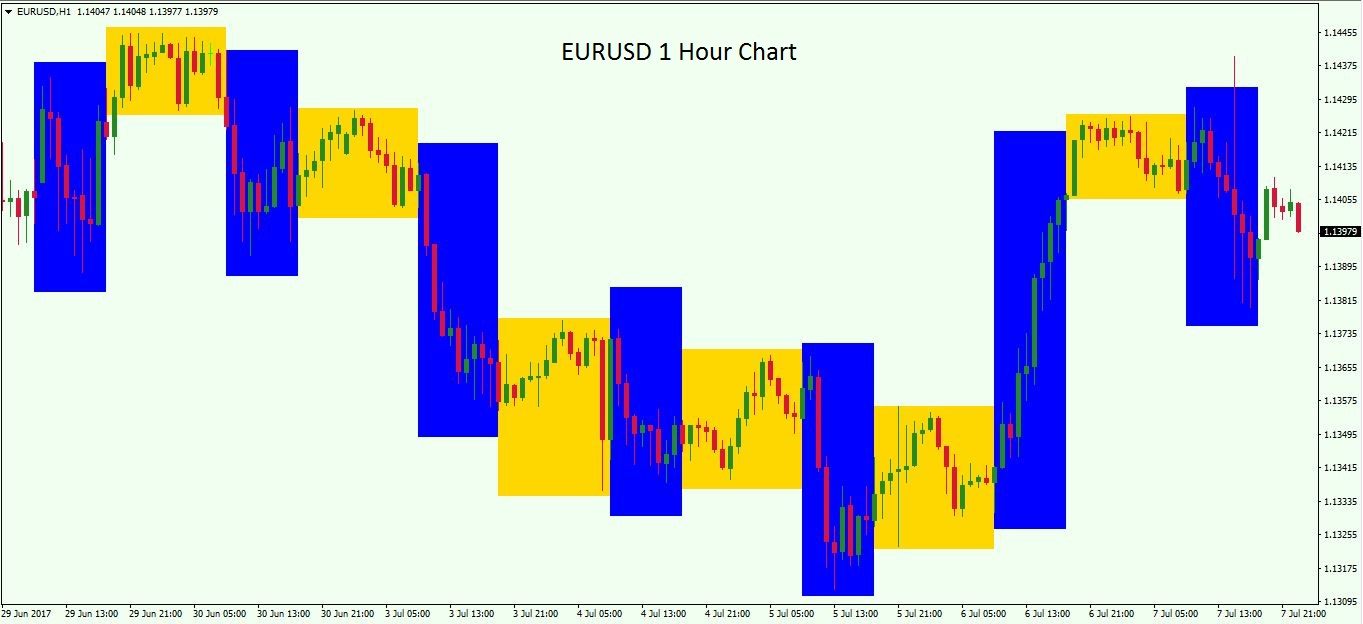

Range Trading Strategy in EUR/USD

Another strategy for trading EUR/USD is range trading. This involves identifying areas of support and resistance on the price chart and trading within those ranges. Traders buy near support levels and sell near resistance levels, aiming to profit from price oscillations.

Breakout Strategy for EUR/USD

A breakout strategy involves trading EUR/USD when the price breaks out of a defined range or consolidation phase. Traders wait for a significant price movement above the resistance or below the support levels before taking a position. This strategy aims to capture strong momentum and potentially large price moves.

These strategies can be combined or used individually based on a trader’s risk tolerance, trading style, and market conditions. It’s essential to learn and understand each strategy’s principles before applying them to actual trading. Keep in mind that no strategy guarantees constant success, and it’s crucial to manage risk and exercise proper money management techniques.

Risk Management and Money Management in EUR/USD Trading

When trading EUR/USD, it’s crucial to implement effective risk management and money management strategies to protect your capital and maximize potential profits.

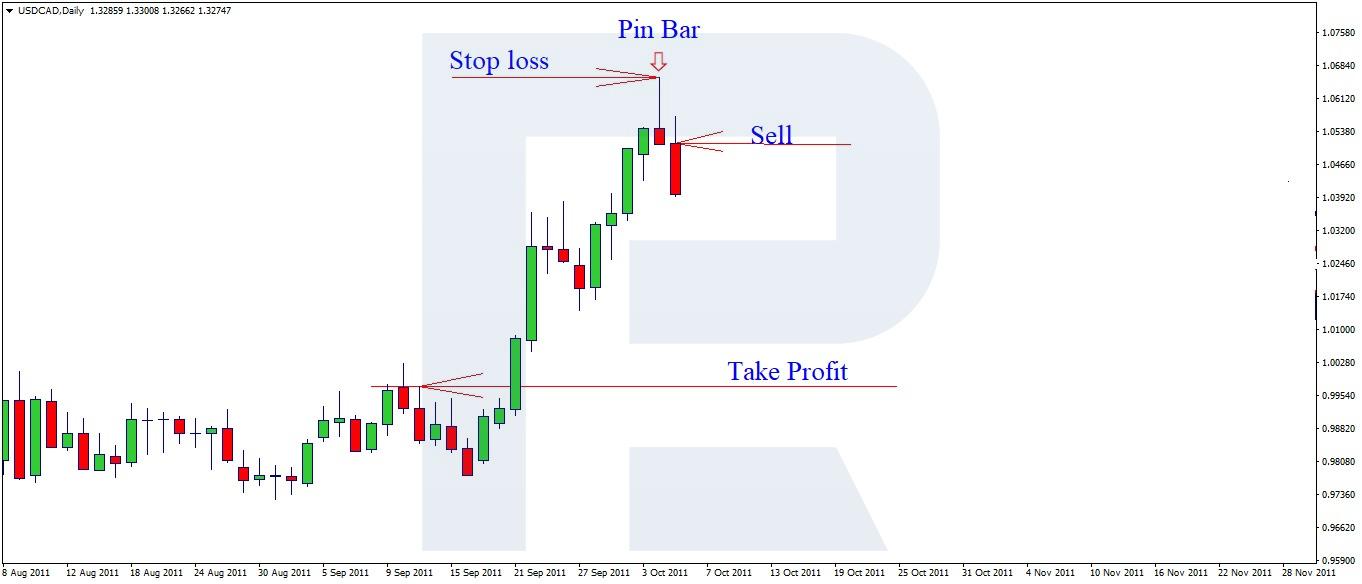

Setting Stop-Loss and Take-Profit Levels

To manage risk in EUR/USD trading, set stop-loss and take-profit levels for each trade. Stop-loss orders help limit potential losses by automatically closing the trade if the price moves against you. Take-profit orders lock in profits by automatically closing the trade when the desired profit level is reached.

Position Sizing and Risk-Reward Ratio

Proper position sizing is key to managing risk. Determine the appropriate position size based on your risk tolerance and account size. Additionally, consider the risk-reward ratio, which compares the potential profit to the potential loss of a trade. Aim for a risk-reward ratio of at least 1:2 or higher to ensure potential gains outweigh potential losses.

Managing Emotions and Staying Disciplined in EUR/USD Trading

In EUR/USD trading, emotions can often cloud judgment and lead to costly mistakes. It’s essential to stay disciplined, adhere to your trading plan, and avoid impulsive decisions based on fear or greed. Implementing stop-loss orders and regularly evaluating your trades based on objective analysis can help in managing emotions effectively.

Following these risk management and money management techniques can significantly improve your overall trading performance in EUR/USD and increase your chances of long-term success. Remember, consistency and discipline are key to successful trading in the forex market.

Key News and Events Impacting EUR/USD

When it comes to trading the EUR/USD currency pair, staying informed about key news and events is crucial. Here are some important factors to keep an eye on:

Economic Calendar and Scheduled Releases

Staying up to date with the economic calendar and scheduled releases is essential as they can significantly impact the EUR/USD exchange rate. Pay attention to indicators such as GDP reports, inflation data, employment figures, and interest rate announcements from both the European Central Bank (ECB) and the Federal Reserve.

Major News Releases and their Effects

News releases, such as geopolitical developments, trade agreements, and other major events, can cause volatility in the EUR/USD pair. Keep an eye on news related to Brexit, European elections, trade tensions, and economic policies, as they can have a direct impact on the currency pair’s movement.

Central Bank Meetings and Policy Decisions

Central banks, particularly the ECB and the Federal Reserve, play a crucial role in determining the value of the EUR/USD pair. Monitor announcements from these central banks regarding monetary policy decisions, interest rate changes, quantitative easing, and forward guidance, as they can lead to significant price fluctuations.

By staying informed about these key news and events, traders can make more informed decisions when trading the EUR/USD pair and adapt their strategies accordingly. Remember to use reliable sources and analyze market trends to gain a comprehensive understanding of the factors impacting the currency pair.

:max_bytes(150000):strip_icc()/eurusd-volatility-by-hour-of-day-589e2d885f9b58819cea0e4f.jpg)

Conclusion

In conclusion, EUR/USD trading can be a lucrative opportunity for forex traders looking to venture into the world of currency pairs. It offers several advantages, including high liquidity, tight spreads, and the ability to capitalize on economic news and events.

Recap of the Importance of EUR/USD Trading

- Liquidity: The EUR/USD pair is the most liquid currency pair in the forex market, making it easier to enter and exit positions.

- Tight Spreads: Due to its popularity, the EUR/USD pair typically has lower spreads, minimizing transaction costs for traders.

- Economic Factors: The Eurozone and the United States are major global economies, and trading the EUR/USD pair allows traders to take advantage of economic news releases and events that can impact the pair.

- Diversification: As a widely traded currency pair, trading EUR/USD can complement other currency pairs in a diversified forex portfolio.

- Technical Analysis: The EUR/USD pair has a history of responding well to technical analysis, providing opportunities for traders who use chart patterns, indicators, and other technical tools.

By understanding the importance of EUR/USD trading and staying informed about the factors that influence its movements, traders can position themselves for success in the forex market. Remember to always conduct thorough research and maintain risk management strategies to maximize your trading potential.

Forex EUR/USD is the currency pair that represents the exchange rate between the euro and the US dollar. It is the most traded currency pair in the world, accounting for over 20% of all daily forex trades.

The value of the euro relative to the US dollar is influenced by a number of factors, including:

- Economic data: Economic data releases such as GDP growth, unemployment rates, and inflation figures can have a significant impact on the EUR/USD exchange rate.

- Interest rates: Interest rates set by the European Central Bank (ECB) and the US Federal Reserve (Fed) also play a role in determining the value of the EUR/USD exchange rate.

- Risk sentiment: When investors are feeling risk-averse, they tend to sell euros and buy US dollars, which is considered to be a safe haven asset.

Forex traders can profit from changes in the EUR/USD exchange rate by buying and selling the currency pair. For example, if a trader believes that the euro is going to rise in value against the US dollar, they can buy EUR/USD. If the euro does rise in value, the trader will profit. However, if the euro falls in value, the trader will lose money.

Forex trading can be a very profitable activity, but it is important to understand the risks involved. Forex trading is a leveraged product, which means that traders can control large positions with a relatively small amount of capital. This can amplify profits, but it can also amplify losses.

It is important to note that forex trading is not suitable for everyone. Forex traders should have a good understanding of the market and the risks involved before they start trading.