eur jpy

EUR/JPY is the currency pair that represents the exchange rate between the euro (EUR) and the Japanese yen (JPY). It is one of the most actively traded pairs in the forex market, attracting both individual traders and institutional investors.

Factors influencing the EUR/JPY exchange rate

Several factors can impact the EUR/JPY exchange rate, including economic indicators, political events, central bank policies, and market sentiment. Economic data such as GDP growth, inflation, and interest rates can significantly influence the value of both currencies and subsequently affect the exchange rate.

The importance of EUR/JPY in forex trading

The EUR/JPY pair offers traders ample opportunities for profit due to its high liquidity and volatility. It allows traders to take advantage of price movements and fluctuations to make informed trading decisions. Additionally, the pair serves as a barometer for overall market sentiment, reflecting trends and reactions to global events.

In conclusion, understanding the dynamics of EUR/JPY as a trading pair and the factors that influence its exchange rate can provide traders with valuable insights and opportunities in the forex market.

Fundamental Analysis of EUR/JPY

Economic indicators affecting EUR/JPY

When analyzing the EUR/JPY currency pair, it’s crucial to consider key economic indicators that impact these two economies. Factors such as GDP growth, inflation rates, employment data, and trade balances can significantly influence the exchange rate. For example, positive GDP growth in the Eurozone can strengthen the euro against the Japanese yen.

The impact of European and Japanese monetary policies

Monetary policies set by the European Central Bank (ECB) and the Bank of Japan (BOJ) have a direct impact on the EUR/JPY exchange rate. Interest rate decisions, stimulus measures, and quantitative easing programs can all affect the value of these currencies. Traders closely monitor these policy decisions and announcements to anticipate potential movements in the exchange rate.

Political events and their influence on the EUR/JPY exchange rate

Political events, such as elections, referendums, and policy changes, can have a significant impact on the EUR/JPY exchange rate. Political stability in both regions can contribute to a strengthening of the respective currencies, while geopolitical tensions or uncertainties can lead to volatility. Traders need to stay informed about political developments to understand how they may affect the EUR/JPY pair.

Remember, fundamental analysis of currency pairs like EUR/JPY requires monitoring economic indicators, central bank policies, and political events to make informed trading decisions.

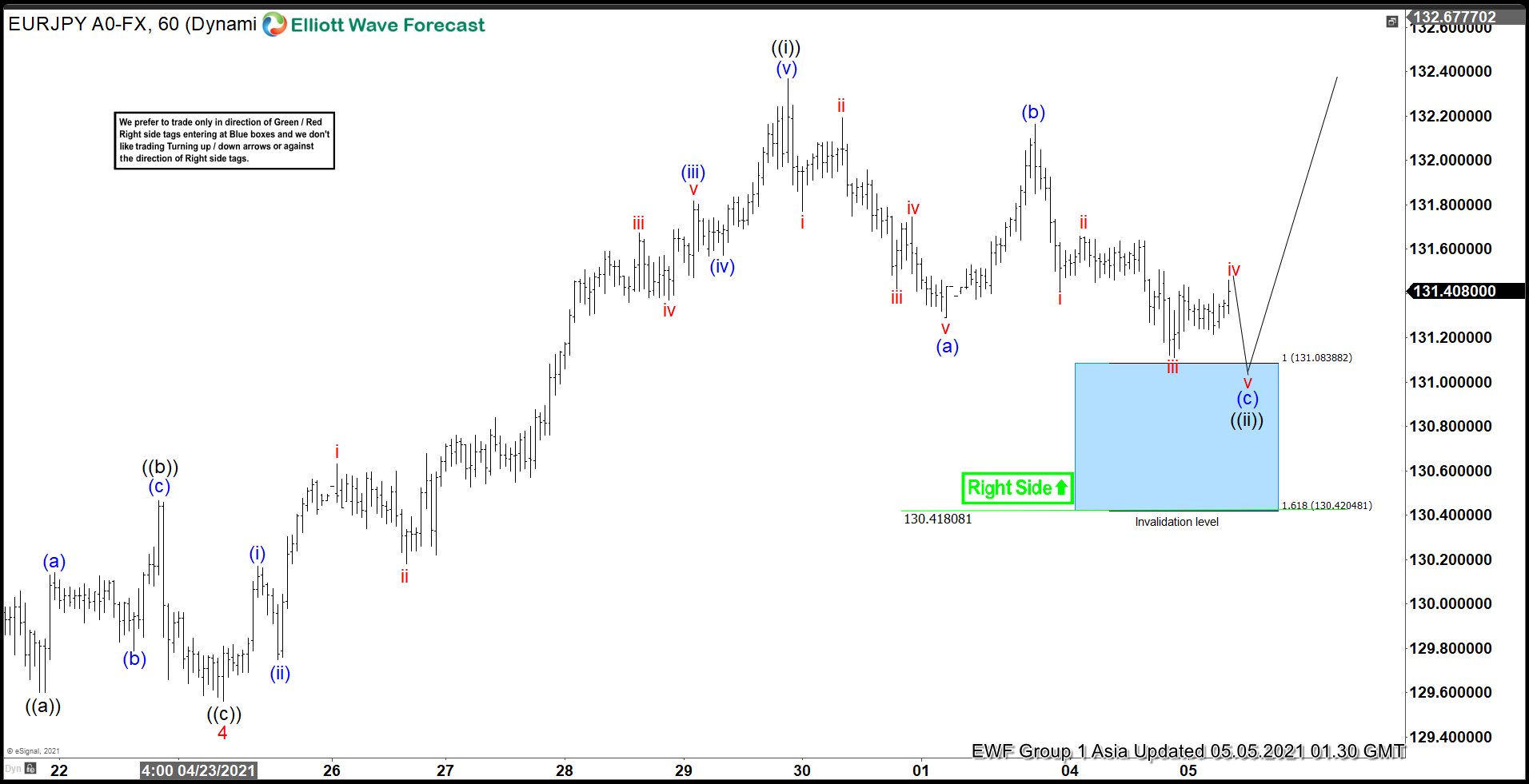

Technical Analysis of EUR/JPY

When it comes to analyzing the EUR/JPY currency pair, there are several key factors to consider. Understanding the key levels and trends, as well as identifying popular chart patterns and utilizing indicators and oscillators, can help traders make informed decisions.

Key levels and trends in EUR/JPY trading

To effectively analyze EUR/JPY, it’s important to keep an eye on key levels and trends. These levels represent significant price levels where the currency pair may experience support or resistance. Identifying these levels can help traders determine potential entry and exit points.

Popular chart patterns in EUR/JPY analysis

Chart patterns can provide valuable insights into future price movements. Some popular chart patterns in EUR/JPY analysis include triangles, double tops and bottoms, and head and shoulders patterns. Recognizing these patterns can help traders identify potential trend reversals or continuation.

Indicators and oscillators for analyzing EUR/JPY

Technical indicators and oscillators can further enhance the analysis of EUR/JPY. Common indicators used in analyzing this currency pair include moving averages, Relative Strength Index (RSI), and the MACD. These tools help traders gauge momentum, trend strength, and potential overbought or oversold conditions.

By considering key levels and trends, identifying chart patterns, and utilizing indicators and oscillators, traders can gain valuable insights into the EUR/JPY currency pair and make informed trading decisions. However, it’s important to remember that technical analysis is just one component of a comprehensive trading strategy.

Trading Strategies for EUR/JPY

When it comes to trading EUR/JPY, having effective strategies in place is crucial for success. Whether you’re looking for long-term or short-term opportunities, it’s important to carefully analyze the market. Here are some strategies and risk management techniques to consider:

Long-term trading strategies for EUR/JPY

- Trend following: Identify the long-term trend using technical indicators and indicators like moving averages. Enter trades in the direction of the trend and hold positions for a longer period.

- Breakout trading: Look for significant price movements and breakouts of key levels. Wait for confirmation and enter trades in the direction of the breakout.

Short-term trading strategies for EUR/JPY

- Range trading: Identify support and resistance levels and trade within the range. Buy near support and sell near resistance.

- News trading: Monitor economic news releases and trade based on the market reaction. Be cautious of increased volatility during news events.

Risk management techniques for trading EUR/JPY

- Use stop-loss orders: Set a predetermined level at which your trade will be automatically closed to limit potential losses.

- Diversify your portfolio: Don’t concentrate all your trades on one currency pair. Spread your risk by including other currency pairs in your trading strategy.

Remember, these trading strategies are not guarantees of success. It’s important to continually monitor the market, adapt your strategy, and have a disciplined approach to risk management. Stay informed and make informed decisions based on current market conditions.

Conclusion

Summary of key points discussed in the blog post

In this blog post, we have explored the importance of branding for your business. We discussed how branding helps distinguish your business from competitors by showcasing your unique values, story, and brand promise. We also highlighted the benefits of becoming more recognizable through consistent branding efforts, which includes increased familiarity, trust, and influence on customer engagement.

Final thoughts on trading EUR/JPY

When it comes to trading EUR/JPY, it is essential to stay informed about market trends, economic indicators, and geopolitical events that can impact currency exchange rates. Keeping a close eye on market analysis, utilizing technical and fundamental analysis tools, and practicing risk management strategies can help traders make informed decisions and potentially profit from EUR/JPY trading.

Recommended resources for further learning about EUR/JPY trading

- Investopedia’s guide on EUR/JPY trading: [link to Investopedia’s EUR/JPY trading guide](insert link)

- DailyFX’s EUR/JPY analysis and news updates: [link to DailyFX’s EUR/JPY analysis](insert link)

- Forex.com’s educational resources on currency trading: [link to Forex.com’s currency trading resources](insert link)

By studying these resources and continually learning about EUR/JPY trading, traders can enhance their understanding of the market and improve their trading strategies.

As of September 26, 2023, the exchange rate between the euro and the Japanese yen is 157.71 EUR/JPY. This means that it takes 157.71 yen to buy one euro.

The euro has been on a slight upward trend against the Japanese yen in recent months. This is due to a number of factors, including:

- **The European Central Bank (ECB) is expected to raise interest rates in the coming months. This will make the euro more attractive to investors.

- **The Japanese economy is expected to grow more slowly than the European economy in the coming years. This will make the euro more attractive to investors.

- **The yen is a historically low-yielding currency, making it an attractive vehicle to fund carry trades (where traders borrow cheaply in JPY to buy higher-yielding currencies, including EUR).

However, there are also some factors that could weigh on the euro against the yen in the coming months, including:

- **The ongoing war in Ukraine could lead to a slowdown in global economic growth, which could hurt the euro.

- **The political situation in Europe could become more unstable, which could also hurt the euro.

- **The Bank of Japan (BOJ) is expected to keep interest rates low for the foreseeable future, which could make the yen more attractive to investors.

Overall, the euro is expected to remain strong against the Japanese yen in the coming months. However, there are some risks that could weigh on the euro, such as the ongoing war in Ukraine and the political situation in Europe.

Here are some of the factors that could affect the EUR/JPY exchange rate in the future:

- Economic growth: Economic growth in Europe and Japan can affect the demand for each currency. If the European economy grows faster than the Japanese economy, the euro is likely to appreciate against the yen.

- Interest rates: Interest rates in Europe and Japan can also affect the exchange rate. If interest rates rise in Europe, the euro is likely to appreciate against the yen.

- Inflation: Inflation can also affect the exchange rate. If inflation is higher in Europe than in Japan, the euro is likely to depreciate against the yen.

- Political stability: Political stability in Europe and Japan can also affect the exchange rate. If there is political instability in either country, the currency is likely to depreciate.

- Market sentiment: Investor sentiment can also affect the exchange rate. If investors are bullish on the euro, the currency is likely to appreciate against the yen.