expert advisor

Overview of Expert Advisors in Forex trading

With Expert Advisors, traders can automate their trading strategies, eliminating the need for manual execution. EAs are programmed to analyze market conditions, monitor price movements, and execute trades accordingly. They can be customized to fit specific trading styles and objectives.

Benefits and advantages of using Expert Advisors

Using Expert Advisors in trading offers several benefits. Firstly, it eliminates emotional trading decisions, as trades are executed based on predefined rules and conditions. This can help traders stick to their strategies without being influenced by fear or greed. Secondly, EAs can operate 24/7, taking advantage of trading opportunities even when the trader is not available. Lastly, EAs can execute trades with lightning-fast speed, ensuring timely entries and exits.

Popular Expert Advisor platforms

There are several popular platforms where traders can access and use Expert Advisors. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used platforms that support automated trading through EAs. These platforms provide a user-friendly interface, advanced charting tools, and a wide range of trading indicators and strategies. Other platforms, such as cTrader and NinjaTrader, also support the use of Expert Advisors.

By leveraging the power of Expert Advisors, traders can automate their trading strategies, increase efficiency, and potentially improve trading results.

Key Features of Expert Advisors

For those looking to automate their trading strategies, Expert Advisors offer a range of valuable features. These powerful tools provide traders with numerous advantages, making them a popular choice in the financial market.

Automated trading and its advantages

By utilizing Expert Advisors, traders can automate their trading strategies. This means that trades can be executed automatically based on predefined criteria, such as specific market conditions or technical indicators. This feature provides several benefits, including increased efficiency, reduced emotional trading decisions, and the ability to trade 24/7, even while away from the computer.

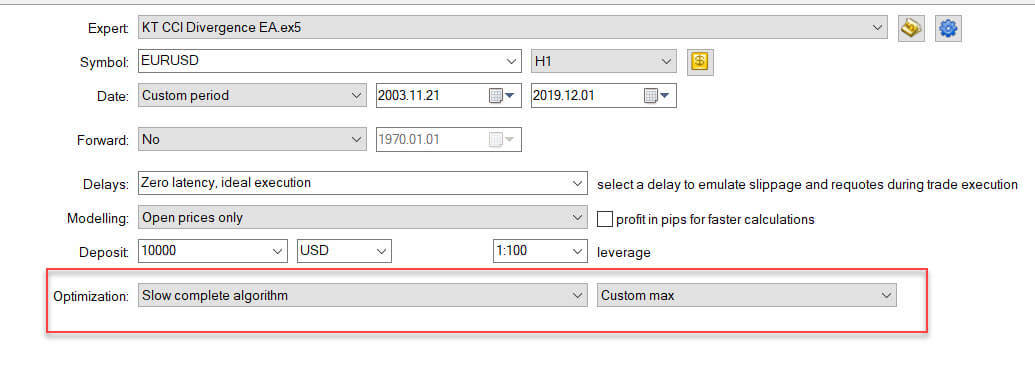

Backtesting and optimization of Expert Advisors

Expert Advisors allow traders to backtest and optimize their strategies. This involves testing the performance of a strategy against historical market data to determine its effectiveness. Traders can then make necessary adjustments and optimize their Expert Advisors to improve their trading results.

Customization and flexibility options

Expert Advisors offer a high level of customization and flexibility. Traders can tailor the parameters of their strategies according to their preferences and trading goals. Additionally, Expert Advisors can be programmed to incorporate various indicators and analytical tools, allowing for a wide range of trading strategies to be implemented.

With these key features, Expert Advisors provide traders with an efficient and reliable way to automate their trading, optimize their strategies, and customize their approach to the financial markets.

Top Expert Advisor Platforms

MetaTrader 4 Expert Advisor Platform

MetaTrader 4 (MT4) is one of the most popular expert advisor platforms in the forex trading industry. It offers a wide range of features and tools for traders to develop, test, and implement their automated trading strategies. With its user-friendly interface and extensive community support, MT4 is a preferred choice for both novice and experienced traders.

MetaTrader 5 Expert Advisor Platform

MetaTrader 5 (MT5) is the successor to MT4 and offers even more advanced features and functionalities. It provides enhanced performance, improved backtesting capabilities, and additional trading instruments. MT5 is highly flexible and supports various asset classes, making it suitable for traders looking to diversify their portfolios.

cTrader Expert Advisor Platform

cTrader is a powerful trading platform that offers an expert advisor platform for automated trading. It is known for its intuitive interface, advanced charting tools, and rapid order execution. cTrader supports algorithmic trading using its cAlgo platform, allowing traders to create and deploy their custom expert advisors. With its comprehensive features and modern design, cTrader is a popular choice among professional traders.

These expert advisor platforms provide traders with the tools and resources to automate their trading strategies, allowing for more efficient and effective trading. Whether you choose MT4, MT5, or cTrader, each platform offers unique features and benefits to cater to different trading needs.

Selecting the Right Expert Advisor

When it comes to trading in the financial markets, using an expert advisor can be a game-changer. But with so many options available, how do you choose the right one for your needs?

Considerations when choosing an Expert Advisor

1.Strategy: Evaluate the trading strategy that the expert advisor uses. Does it align with your own trading goals and risk tolerance?

2.Performance: Look at the track record of the expert advisor. Check for consistent profits and low drawdowns to ensure reliability.

Factors to evaluate in Expert Advisor performance

1.Profitability: Examine the historical performance of the expert advisor. Look for a consistent track record of generating profits.

2.Drawdown: Consider the maximum drawdown, which represents the potential risk of the strategy. A lower drawdown indicates better risk management.

Finding a reliable Expert Advisor provider

Choose a reputable provider: Research and read reviews about the expert advisor provider’s reputation and customer support. Look for transparency in their trading results.

Consider a trial: Some expert advisor providers offer trial periods or money-back guarantees. Take advantage of these to test the expert advisor’s performance in real market conditions.

Remember, selecting the right expert advisor requires careful consideration of the strategy, performance, and reliability of the provider. By doing thorough research and analysis, you can find the expert advisor that best suits your trading needs.

Maximizing the Potential of Expert Advisors

When it comes to trading in the financial markets, expert advisors can be valuable tools for traders looking to maximize their potential. Here are a few key points to consider when using expert advisors:

Optimizing Expert Advisor settings

To get the most out of your expert advisor, it’s important to optimize its settings. This involves carefully selecting the parameters that suit your trading strategy and risk tolerance. By customizing the settings to your specific needs, you can enhance the performance of your expert advisor and improve your trading results.

Risk management strategies when using Expert Advisors

Managing risk is crucial when using expert advisors. It’s important to set appropriate risk parameters, such as stop-loss levels and position sizes, to protect your capital. Additionally, regularly reviewing and adjusting these parameters based on market conditions can help mitigate potential losses and improve overall risk management.

Monitoring and adjusting Expert Advisors

While expert advisors can automate trading tasks, it’s essential to monitor their performance regularly. This includes reviewing trading results, analyzing market trends, and making necessary adjustments to optimize performance. By keeping a close eye on your expert advisor and making informed adjustments when needed, you can ensure it continues to work effectively for your trading goals.

In conclusion, by optimizing settings, implementing effective risk management strategies, and monitoring performance, traders can maximize the potential of expert advisors in their trading endeavors.

Common Challenges and Troubleshooting

When it comes to using Expert Advisors, there are a few common challenges that traders may encounter. However, with some troubleshooting strategies, these issues can be overcome. Here are a few key points to keep in mind:

Dealing with technical issues in Expert Advisors

- Technical issues can arise while using Expert Advisors, such as coding errors or compatibility problems with the trading platform. It is essential to have a reliable technical support system in place to address any technical issues promptly.

Avoiding common mistakes when using Expert Advisors

- Traders should exercise caution to avoid common mistakes when using Expert Advisors. Some common mistakes include improper strategy selection, inadequate testing, and insufficient risk management. It is crucial to thoroughly research and understand the strategies implemented by the Expert Advisor to maximize its effectiveness.

Troubleshooting strategies for improving Expert Advisor performance

- To improve the performance of an Expert Advisor, traders can consider implementing troubleshooting strategies, such as:

- Regularly monitoring and analyzing the performance metrics of the Expert Advisor.

- Reviewing and adjusting the parameters and settings of the Expert Advisor based on market conditions.

- Backtesting and forward testing the Expert Advisor to ensure its effectiveness.

- Continuously updating and optimizing the Expert Advisor to adapt to changing market trends.

By effectively dealing with technical issues, avoiding common mistakes, and implementing troubleshooting strategies, traders can optimize the performance of their Expert Advisors and enhance their trading experience.

Expert Advisor vs. Manual Trading

Comparison between Expert Advisors and manual trading

When it comes to trading in the financial markets, investors have two primary options: Expert Advisors (EAs) and manual trading. EAs are automated trading systems, while manual trading involves making trading decisions based on analysis and intuition.

Expert Advisors: These trading robots use algorithms to execute trades automatically. They can analyze market data, identify trading opportunities, and even manage risk on behalf of the trader. EAs offer the advantage of speed, accuracy, and the ability to trade 24/7 without human intervention.

Manual Trading: This approach relies on the trader’s skill, experience, and decision-making abilities. Traders who prefer manual trading enjoy the flexibility to adapt to changing market conditions, apply their own strategies, and have full control over every trade executed.

While Expert Advisors offer efficiency and convenience, manual trading provides a more personalized and hands-on trading experience. Traders who are highly skilled and enjoy analyzing market trends may prefer manual trading, whereas those who prefer a more systematic and automated approach may find Expert Advisors more suitable.

It’s important to note that both approaches have their pros and cons. Expert Advisors can save time and eliminate emotional decision-making, but they may lack the subjective analysis that manual traders can apply. On the other hand, manual trading requires discipline and constant monitoring, but it allows for greater flexibility and adaptability.

In the end, the choice between Expert Advisors and manual trading depends on your trading style, goals, and personal preferences. Some traders may prefer a combination of both approaches to benefit from the advantages they offer.