index dax

Introduction to Index DAX

Index DAX is a stock market index that represents the 30 largest and most actively traded companies on the Frankfurt Stock Exchange in Germany. It is widely regarded as a benchmark for the German stock market and provides valuable insights into the overall performance and trends of the German economy.

Overview of Index DAX and its importance in the financial world

Index DAX plays a crucial role in the financial world by serving as an indicator of the health and stability of the German economy. It is closely followed by investors, analysts, and economists to gauge the performance and direction of the stock market. The index is also used as a basis for financial instruments such as exchange-traded funds (ETFs) and derivatives.

Understanding the structure and composition of Index DAX

The composition of Index DAX is reviewed annually in September, with the selection of the 30 companies based on their market capitalization and trading volume. The index is weighted by market capitalization, meaning that larger companies have a greater impact on its performance. The companies included in the index cover various industries, including automobile manufacturing, financial services, technology, and healthcare.

Key factors influencing the performance of Index DAX

Several factors can impact the performance of Index DAX, including economic indicators, geopolitical events, and company-specific news. Changes in interest rates, inflation rates, and GDP growth can significantly influence the overall sentiment of the stock market. Additionally, global events and market trends can also have a substantial impact on the index’s performance, making it crucial for investors to stay informed and monitor these factors.

Advantages and Benefits of Index DAX

The role of Index DAX in measuring the performance of German stock market

The Index DAX, short for Deutscher Aktienindex, is a stock market index that represents the performance of the 30 largest and most actively traded companies listed on the Frankfurt Stock Exchange. It serves as a reliable measure of the German stock market, providing investors and analysts with a snapshot of how these companies are performing. Tracking the Index DAX allows market participants to gauge the overall health of the German economy and make informed investment decisions.

Investment opportunities and diversification benefits offered by Index DAX

Investing in the Index DAX offers several advantages. Firstly, it provides exposure to a diverse range of companies spanning various sectors, including automotive, financial services, and technology. This diversification helps mitigate the risks associated with investing in individual stocks. Additionally, the Index DAX offers liquidity, making it easier for investors to buy and sell shares of the constituent companies. Furthermore, the strong and stable German economy provides a solid foundation for potential growth and returns on investment.

How Index DAX serves as a benchmark for fund managers and investors

The Index DAX serves as a benchmark for fund managers and investors to compare the performance of their investment portfolios against the broader market. Fund managers aim to outperform the Index DAX, which serves as a measure of success. Investors can use the Index DAX as a performance indicator for their individual stock investments or other financial products tied to the index. Tracking the index allows them to assess their portfolio’s performance and make informed decisions about allocating their investments.

In summary, the Index DAX plays a crucial role in measuring the performance of the German stock market, offers investment opportunities and diversification benefits, and serves as a benchmark for fund managers and investors to evaluate their portfolios.

Components of Index DAX

The DAX, or Deutscher Aktienindex, is a key stock market index in Germany that represents the performance of the top 30 largest publicly traded companies. It is an important benchmark for the German economy and provides investors with insight into the overall health of the market. Let’s take a closer look at some key aspects of the DAX.

Top 3 companies listed in Index DAX and their contribution to the index

- SAP: As Germany’s largest software company, SAP holds a significant share in the DAX. Its innovative software solutions and services contribute to the index’s performance.

- Siemens: Siemens, a global conglomerate, is one of the largest industrial manufacturing companies listed in the DAX. Its diverse range of products and services helps drive the index’s growth.

- Volkswagen: Known for its iconic automotive brands, Volkswagen is a major player in the DAX. Its production and sales figures greatly impact the index’s performance.

Analysis of sector-wise distribution in Index DAX

The DAX is made up of companies from various sectors, including automotive, technology, manufacturing, consumer goods, and finance. The automotive sector has a significant presence in the index, followed by technology and industrial sectors. This diversification allows for a balanced representation of Germany’s economy within the DAX.

Factors influencing the inclusion or exclusion of companies in Index DAX

To be included in the DAX, a company must meet specific criteria set by Deutsche Börse, the operator of the Frankfurt Stock Exchange. Factors such as market capitalization, trading volume, and free float market capitalization play a crucial role in determining a company’s eligibility for inclusion. The composition of the DAX is reviewed regularly to ensure that it accurately reflects the performance of Germany’s top companies.

Performance Analysis of Index DAX

Historical data and trends of Index DAX performance

The Index DAX, Germany’s main stock market index, has a rich history of performance. Tracking the performance of the top 30 German companies, it provides valuable insights into the overall health of the German economy. By analyzing historical data and trends, investors can identify patterns and make informed decisions.

Comparative study of Index DAX with other global stock market indices

When comparing the performance of Index DAX with other global stock market indices, such as the S&P 500 or FTSE 100, it’s important to consider factors like market size, industry composition, and geopolitical events. The comparative study allows investors to gauge the relative strength and performance of different markets and identify potential investment opportunities.

Analyzing factors affecting the volatility and stability of Index DAX

A variety of factors can influence the volatility and stability of Index DAX. These include economic indicators, political developments, interest rates, and market sentiment. By closely analyzing these factors, investors can gain insights into potential risks and opportunities in the German stock market.

By examining the historical performance, conducting comparative studies, and analyzing influential factors, investors can gain valuable insights into the performance of Index DAX and make informed investment decisions.

Conclusion

Summary of the key takeaways from the blog post on Index DAX

In this blog post, we discussed the importance of branding your business to stand out from competitors and become more recognizable to your target audience. Branding goes beyond creating a logo and slogan – it involves defining your unique values, story, and brand promise. By leveraging these assets, you can differentiate yourself from the competition and make a lasting impression on customers.

Importance of closely monitoring and understanding Index DAX for investors

For investors, closely monitoring and understanding the Index DAX is crucial. The Index DAX represents the performance of the 30 largest and most liquid companies listed on the Frankfurt Stock Exchange. By tracking this index, investors can gain insights into the overall health and direction of the German stock market. This knowledge is essential for making informed investment decisions.

Future prospects and potential growth of Index DAX in the financial market

Looking ahead, the future prospects for the Index DAX remain positive. As Germany’s economy continues to evolve and grow, the companies listed on the DAX are poised for potential growth. Additionally, with the increasing globalization of financial markets, the Index DAX will likely attract more international investors seeking exposure to the German market. Therefore, keeping a close eye on the Index DAX could present exciting opportunities for investors in the years to come.

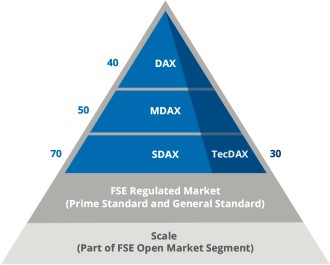

The DAX index is a stock market index that tracks the performance of the 40 largest German companies trading on the Frankfurt Stock Exchange. It is one of the most important stock indices in Europe and is widely used as a benchmark for German and European equities.

The DAX index is a market-value weighted index, meaning that the weights of the individual stocks in the index are proportional to their market capitalization. This means that the largest companies in the index have the biggest impact on its performance.

The DAX index is calculated and published every second during trading hours. It is also calculated and published on weekends and public holidays.

The DAX index is used by a wide range of investors, including individuals, institutions, and hedge funds. It is used to track the performance of the German stock market, to benchmark the performance of investment funds, and to make investment decisions.

Here are some of the factors that can affect the DAX index:

- Economic growth: The DAX index is sensitive to economic growth in Germany and Europe. When the economy is growing, the DAX index tends to rise. When the economy is contracting, the DAX index tends to fall.

- Interest rates: The DAX index is also sensitive to interest rates. When interest rates rise, the cost of borrowing money increases, which can hurt corporate profits and lead to a decline in the DAX index.

- Inflation: Inflation can also have a negative impact on the DAX index. Inflation erodes the value of corporate profits and can lead to lower stock prices.

- Investor sentiment: Investor sentiment can also affect the DAX index. When investors are bullish on the German stock market, the DAX index tends to rise. When investors are bearish on the German stock market, the DAX index tends to fall.

The DAX index is a valuable tool for investors who want to track the performance of the German stock market and make informed investment decisions.