nasdaq tesla

Overview of NASDAQ stock exchange

The NASDAQ stock exchange is one of the world’s largest and most prestigious stock exchanges. It is known for being a technology-focused marketplace and is home to many high-profile companies, including Tesla. It provides a platform for investors to buy and sell stocks, bonds, and other securities. The NASDAQ prides itself on its innovative nature, offering advanced trading systems and cutting-edge technology.

Overview of Tesla as a company

Tesla, founded in 2003 by Elon Musk, has become a household name in the electric vehicle industry. It is a renowned manufacturer of electric cars, solar energy products, and energy storage solutions. Tesla’s mission is to accelerate the world’s transition to sustainable energy. The company’s groundbreaking innovations, such as the Model S, Model 3, and Cybertruck, have positioned Tesla as a leader in the automotive industry. With a strong emphasis on innovation and sustainability, Tesla continues to revolutionize the way we think about transportation and energy.

NASDAQ and Tesla’s Stock Performance

Tesla’s journey on the NASDAQ

Tesla (TSLA), the electric vehicle manufacturer, has had a remarkable journey on the NASDAQ. Since its initial public offering (IPO) in 2010, Tesla’s stock has experienced significant ups and downs. It started with a modest IPO price of $17 and has soared to new heights, surpassing $800 per share in recent years. Tesla’s stock has attracted attention from investors worldwide, making it one of the most talked-about companies in the stock market.

Factors influencing Tesla’s stock price

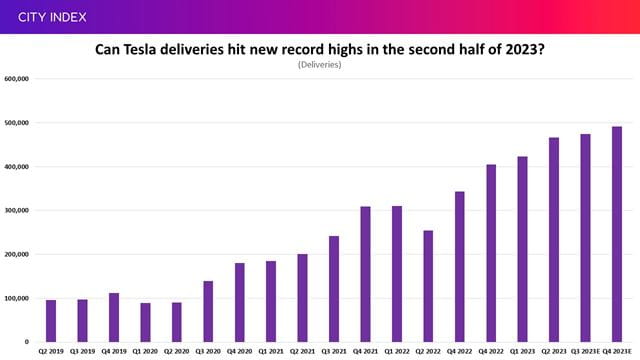

Several factors have influenced Tesla’s stock price volatility. These include production numbers, sales figures, profitability, vehicle quality, regulatory changes, and global economic conditions. Additionally, Tesla’s charismatic CEO, Elon Musk, has played a crucial role in shaping investor sentiment and market perception of the company. Musk’s ambitious goals, innovative vision, and captivating announcements have often impacted Tesla’s stock price positively or negatively.

Tesla’s market capitalization and stock valuation

Tesla’s market capitalization has surged over the years. It surpassed the market value of traditional automakers despite producing significantly fewer vehicles. The market has shown high confidence in Tesla’s future growth potential, leading to impressive stock valuations. However, this has also sparked debates and discussions within the investment community about the sustainability of Tesla’s valuation and its potential for future growth.

In summary, Tesla’s stock performance on the NASDAQ has been a captivating rollercoaster ride. The company’s success is influenced by various factors, including production numbers, sales figures, profitability, regulatory changes, and investor sentiment. Tesla’s market capitalization and stock valuation have reached remarkable heights, attracting attention from investors worldwide.

Tesla’s Impact on the Electric Vehicle Market

Tesla’s role in revolutionizing the electric car industry

Tesla, led by visionary Elon Musk, has played a pivotal role in revolutionizing the electric car industry. With their innovative designs, advanced technology, and high-performance vehicles, Tesla has managed to change the perception of electric cars from being slow and unappealing to fast, stylish, and environmentally friendly.

Competition in the electric vehicle market

Tesla faced competition from established automakers as well as new entrants in the electric vehicle market. Companies like Chevrolet, Nissan, and BMW have launched their own electric models, aiming to grab a share of the growing market. However, Tesla’s strong brand, loyal customer base, and continuous investment in research and development have helped them maintain their leadership position.

Tesla’s market share and global presence

Despite facing competition, Tesla has managed to capture a significant market share in the electric vehicle industry. They have successfully expanded their global presence by establishing production facilities in different countries and developing a network of Supercharger stations, making long-distance travel convenient for Tesla owners. Tesla’s success has also influenced other automakers to invest more in electric vehicle technology and infrastructure.

In conclusion, Tesla’s impact on the electric vehicle market cannot be underestimated. Through their innovative designs, fierce competition, and global expansion, Tesla has not only revolutionized the industry but also paved the way for a greener and more sustainable future in transportation.

NASDAQ and Tesla’s Financial Performance

Tesla’s revenue and profitability

Tesla, the leading electric vehicle manufacturer, has experienced robust revenue growth in recent years. In 2020, the company reported record-breaking revenue of $31.5 billion, representing a remarkable 27% increase compared to the previous year. This surge can be attributed to the growing demand for electric vehicles and Tesla’s expanding product lineup.

Moreover, Tesla has made significant progress in improving its profitability. The company achieved its first full-year profit in 2020, with a net income of $721 million. This demonstrates Tesla’s ability to effectively manage costs and generate sustainable earnings.

Performance indicators and financial ratios

When analyzing Tesla’s financial performance, several key performance indicators and financial ratios are worth considering. These include revenue growth rate, gross profit margin, operating profit margin, and return on investment (ROI).

Tesla’s strong revenue growth rate indicates its ability to capture market share and increase sales. Furthermore, the company’s gross profit margin and operating profit margin have shown consistent improvement, demonstrating effective cost management and operational efficiency.

As for ROI, Tesla’s stock has garnered significant attention from investors due to its substantial returns. The company’s unique position in the electric vehicle market has attracted both individual and institutional investors, leading to positive investor sentiment.

Investor sentiment towards Tesla’s stock

Investors have shown significant interest in Tesla’s stock, driven by the company’s innovative approach, strong financial performance, and future growth prospects. Tesla’s disruptive presence in the automotive industry and its strategic expansion into renewable energy and technology have positioned it as a leader in sustainable transportation.

Despite occasional fluctuations, Tesla’s stock has experienced considerable appreciation over the years, making it an attractive investment option for many. However, potential investors should carefully evaluate market conditions, regulatory factors, and Tesla’s long-term growth plans to make informed investment decisions.

Conclusion

Despite its ups and downs, NASDAQ and Tesla have proven to be intriguing investment opportunities. By analyzing their future outlook and potential risks, investors can make informed decisions. It’s important to note that while Tesla has remarkable growth potential, it’s not without its risks. Additionally, keeping an eye on the performance of NASDAQ as a whole is crucial for understanding the broader market trends. In summary, investors should consider the long-term prospects of these investments and stay updated on industry news. With careful analysis, there is potential for lucrative returns in both NASDAQ and Tesla.

Tesla, Inc. (TSLA) is an American electric vehicle and clean energy company. It is headquartered in Austin, Texas, and was founded in 2003. Tesla’s mission is to accelerate the world’s transition to sustainable energy.

Tesla is one of the most valuable companies in the world, with a market capitalization of over $777 billion. Its stock is traded on the Nasdaq stock exchange under the ticker symbol TSLA.

Tesla’s stock has been on a wild ride in recent years. It reached an all-time high of $1,243.49 in November 2021, but has since fallen by more than 50%.

Despite the recent decline, Tesla remains a popular stock among investors. The company is seen as a leader in the electric vehicle market, and its stock is well-represented in many popular ETFs and mutual funds.

Here are some of the factors that could affect Tesla’s stock price in the future:

- Demand for electric vehicles: The demand for electric vehicles is expected to grow significantly in the coming years. This is due to a number of factors, including government incentives, environmental concerns, and the rising cost of gasoline.

- Tesla’s production capacity: Tesla is currently expanding its production capacity in order to meet the growing demand for its vehicles. However, there is some concern that the company may not be able to keep up with demand, especially if electric vehicle sales continue to accelerate.

- Tesla’s competition: Tesla faces increasing competition from other automakers, such as Volkswagen, Ford, and General Motors. These companies are investing heavily in electric vehicles, and they could pose a threat to Tesla’s market share.

- Tesla’s financial performance: Tesla’s financial performance has been improving in recent quarters. However, the company is still not profitable on a sustained basis. Investors will be closely monitoring Tesla’s financial results in the coming quarters to see if the company can finally achieve profitability.

Overall, Tesla is a high-risk, high-reward stock. The company has the potential to be a major player in the electric vehicle market, but it also faces a number of challenges. Investors should carefully consider their own risk tolerance and investment goals before investing in Tesla stock.